Moving from manual to online accounting to comply with MTD is at best missing a huge opportunity and at worst setting yourself up to fail. A move to Cloud computing – whether you’re online already or not – has the same potential consequences. This blog post explains why and suggests what you can do to exploit rather than suffer your firm’s technological evolution.

Harder Better Faster Stronger

If you know me, you’ll also know our firm Farnell Clarke and probably some of our history. We have a reputation for being innovative, are fully digital and provide end-to-end cloud based digital services. Over the years we’ve learned by talking to experts and innovators, dissecting our experiences, testing, trial and by the occasionally painful error. Our processes have become better and more resilient. We can deliver ad-hoc information to our clients fast enough to support their decisions real time, and our growth (36% year on year for over a decade) has exceeded expectations. Meanwhile many of our peers have evolved in similar ways. I’m sure you can imagine that, as we’ve grown, I’ve spent a lot of time thinking through what worked and what did not. I now use that experience as a basis for conversations with accounting firms because I want to pass that learning on so that other firms can thrive.

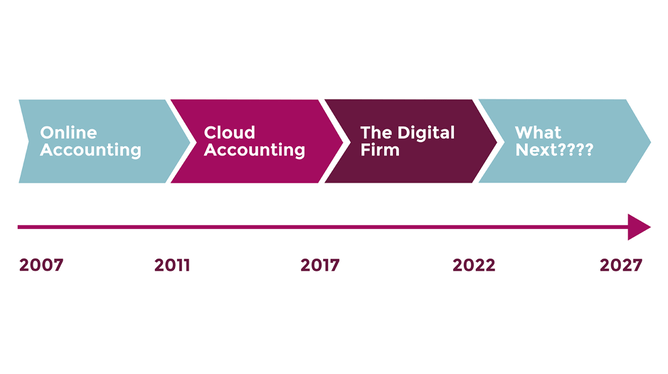

My focus is to reduce the time it takes for others to get to a similar stage of development as us, and I believe it’s reasonable to expect to cut at least three development years by working with others who follow a comparable path. Don’t be alarmed if you’ve not implemented it yet. To set that scene, I need to explain how accounting has evolved. Those of us who have adopted tech and processes to the extent I describe are the leading (and sometimes bleeding) edge. By my estimate as many as 99% of the accounting firms in the UK have yet to exploit what is now available.

Going Online

Back in 2007 we were comfortable with the idea of using the internet. Why wouldn’t we want access to client data 24/7? Why wouldn’t we want access to the same ledger on which our clients were working? Adopting accounting products that could be used online was, for me, a no-brainer. Even so, it took 18 months before we found the right product in KashFlow. Having just one version of ledger has so many advantages. By the end of 2009 we were using online accounting to help every single client process transactions and to assist in their decision making in a more timely manner. It didn’t hurt that we were pigeon-holed as new breeds of online accountants because that was my vision; to provide accounting services based on an objective, client-centric view.

From the beginning my driver was to find ways of working with our clients that would be better for clients and more effective for us all. People like Paul Bulpitt and the WOW Company took the same approach. I believe we found ourselves using remarkably similar tech and approaches. In the context of our client-centred service objectives that tech made sense.

So Many Paths; The Online Accounting Era

Many other firms – our peers - underwent a similar evolution between 2007 and 2011, a period I call the Online Accounting Era. Although the markets’ perception was that online accountants were all about doing it really cheaply and not caring about their relationships with their clients, my peer early-adopters’ visions were more complex. Here’s an outline of the three digital paths, slightly different from our own that was purely focussed on delivering better clients experience. You’ll see each serves a different business approach:

1. Never tie me down

At the beginning, most firms who adopted online accounting were thinking about servicing clients all over the UK without requiring them to visit the office. Other small one-man firms (clients and accountants alike) might not have wanted to be so tied down to their own office location. This has become increasingly important as many millennials are peripatetic in both habits and lifestyle. As they form an increasing proportion of our client market, the option to provide for them gives a significant competitive advantage.

2. $ave Dat Money / A Small Package Of Value Will Come To You Shortly

Others chose online accounting as the basis of a cost leadership strategy, making it clear from the start that they were providing a cheap service. Complete removal - without face to face contact - would allow the delivery of clients’ service in best possible way for their money. From where I sat it seemed clear that such offerings were possible through exploiting new tech.

3. The Crunch

Then there were the firms like Crunch (crunch.co.uk). They built a complete tech solution and wrapped advice around it. Accountancy is an intrinsic part of the process, and they absolutely nailed it in terms of marketing and new tech.

Your Cloud; The Cloud Accounting Era

The first - quite bitty - stage in the evolution of the modern accounting firm (online accounting, in-cloud General Ledgers, manual data entry and cloud-based back-ups) was succeeded by the Cloud Accounting Era. However bitty it was, it was in this era that we found a sense of clarity about what was (and would soon be) possible.

Starting in 2011 and ending early in 2017, the era encompassed the evolution of the Cloud as a ‘thing’ in which application programmes (which slowly became known as apps and eponymous add-ons) started to become available, and - more importantly for us – started to seamlessly link with the General Ledger. We at Farnell Clarke started taking add-on partners such as Receipt Bank and GoCardless back in 2012. Each add-on provided a new dimension of service, greater efficiency, better processing and a greater level of automation in the way we did our job as accountants.

During the latter stages of the cloud accounting era a non-tech shift arose. Because we could more tightly control what we did, we were able to put together service packages and a pricing menu. We’ve now moved beyond that, but at the time it was a natural part of our evolution, and a natural result of the way we were thinking about what we wanted to deliver.

We were fortunate to be the early adopters, the pioneering firms. We have nailed it (to a degree), have built processes around our cloud computing, have recognised the importance of delivering different types of new services to clients and understand the importance of culture and branding. I believe a small group of firms - maybe 1% of the UK market or 350 other firms took - to the Cloud in a similar way to us, creating largely automated processes, realising and utilising the potential that the right mix of tech people and process creates. For us early adopters 2017 became a tipping point and became known as the year of the Fully Digital Firm.

This engendered a conceptual – rather than tech – jump. It was a period of exploration where we got the best out of our tech and how we packaged it. Almost the start of the commoditisation of accounting services, the tech, and the thinking behind it, changed everything.

From Cloud to Fully Digital Accounting – The Cloud v2.0 and on

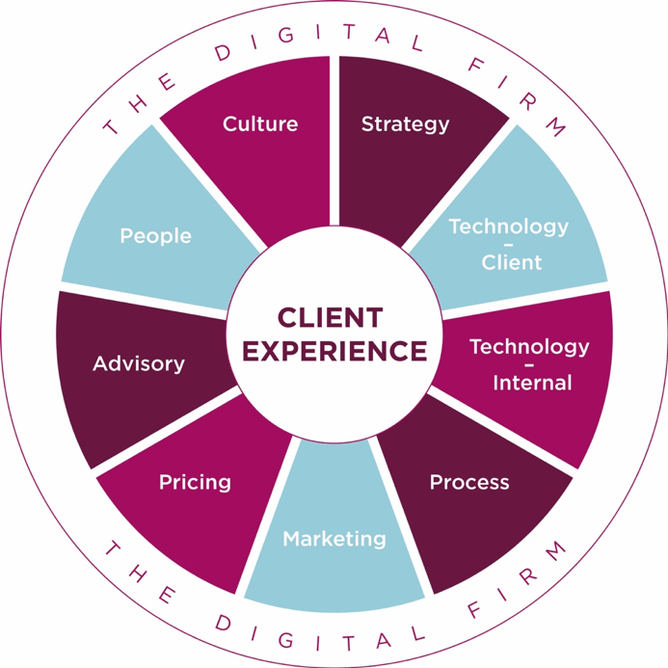

During 2017, as we came to a complete understanding of where the tech is and what it is capable of, I naturally started thinking about what to do next. I had recognised during the cloud accounting era that all this end-to-end tech would make it far easier for us (and ultimately everyone else) to deliver compliance, and that this would inevitably drive down compliance prices. That’s why we started thinking about how we could deliver good value to our clients and exceptional client experience with follow-on services that would supplement the compliance income. Alongside this, I looked at how could we continue to utilise the additional capacity created through automation of our core work.

We’ve built the processes and systems, a different type of team structure and are able to deliver our services in the most efficient way possible. We are delivering bookkeeping in 4 minutes per day per client and filing accounts within 4 months of year end. That means we are now able to develop a focus based completely around client experience.

New Service

What we are doing now is delivering better services and building great relationships with our clients. This helps us better understand their business, their goals, aspirations and challenges and such insights, together with live accounting data also helps us identify ways to supplement compliance income.

We’ve been careful to demonstrate offerings above and beyond traditional client services and use our website to give clients and potential clients alike a better idea of the range of services we offer and how we deliver these offerings. And doing things differently gives us significant advantages. We use daily book-keeping to build better relationships with our clients as it’s no longer a prohibitively expensive service.

That’s how firms in this era can be recognised. We have fully digital end-to-end processes and 100% of our clients use cloud-based solutions both for input and General Ledger. More than 75% of clients pay via direct debit with output based (not time-based) pricing, around 60% of our clients pay for daily bookkeeping services and our digital marketing, brand, culture and client experience are all inextricably interlinked.

The Wheel I’ve shared above suggests some of the things you need to be thinking about to support your firm’s evolution to this stage.

Everything Has Changed

And this takes us to the opportunity firms have today.

Having already focussing on providing more opportunities for touch points for our clients, providing more quality, we are now working on developing our brand, becoming commercial organisations in ways we have not before, and on what that means for our staff, our clients and our culture. Part of this is recognising the generational shift in attitudes, part is building on the opportunities a fully digital firm can provide, and part is a development of the continuous shift in thinking that the eras of accounting have provided.

Our blend of the right people, process and tech has allowed us to make bold leaps in defining our culture. This includes 6 hour working days and unlimited annual leave, underpinned by a high performance team focussed environment.

Once you stop you focussing on the old and start focussing on the new, exciting things can happen. Understand the concepts behind each era of accounting evolution you can leapfrog three years of the development process, and I would be delighted to help.

Numbers

Back in September 2018, 6 months before the introduction of MTD, only 11% of businesses were filing VAT returns using software, that’s only 110,000 out of a total of around 1,000,000. That’s a lot of work when you consider how close MTD is!

There are about 5.2m small businesses in the UK and less that 1m are using a cloud general ledger based on last published numbers for the main cloud providers. Taking these stats into account, at best we have 20% of the UK accounting market truly engaged in a journey towards being cloud accountants, a state of play far removed from a digital firm. That’s why the opportunity to be an early adopter of cloud technology still exists in 2019 UK.

Make No Mistake

Who will be prepared to pay for horrendously time-consuming manual compliance reporting four or six times a year when other options are available? There are other threats to traditional accounting services than MTD (or its equivalent, as other countries compliance for things such as Sales Tax are going digital). Disruptive organisations and emerging digital firms with different approaches and integrated tech are creating new niches, grabbing more clients and will beat most firms on price. Firms therefore need to understand how to compete.

Make no mistake, the firms I’m currently talking with are still in the top quartile. It’s still not too late to change, and while some may feel they’ve missed the boat, this is not yet the case. And here is the nub. Bear in mind that if your objective is simply to move accounts and reporting online while still manually keying in data, you are aiming at a 10 year-old business model. If you’re aspiring to Cloud based accounting, you’re still shooting for something that was surpassed two to three years ago. Both could do better. By not doing so firms’ long term profitability and survival are threatened.

Changes; In Conclusion

MTD is big, and an opportunity to ease clients into the idea that changes must come while putting in place software and processes that will help the firm into the future. But that’s not all. 2019 marks the transition to another stage of accounting potential. It’s about live data that’s real time (or near as makes no object) and the people it serves. I’ll post more on these subjects in the future.

Did you miss the song tracks?

Right On Track by Breakfast Club

Harder Better Faster Stronger by Daft Punk

So Many Paths by Hawkwind

Never Tie Me Down by Chris Rea

$ave Dat Money by Lil Dicky

A Small Package Of Value Will Come To You Shortly by Jefferson Airplane

The Crunch by The Rah Band

Your Cloud by Tori Amos

New Service by New Kids on the Block

Everything Has Changed by Taylor Swift

Numbers by Ryan Adams and the Cardinals

Make No Mistake by Keith Richards

Changes by David Bowie